Bodies implementing state pension provision. The Pension Fund of the Russian Federation is the main body for pension provision. D) Conditions for providing pensions

The pension system in Russia is under state control. The leading organization responsible for making the relevant payments is the Russian Pension Fund.

Public services within the competence of the Pension Fund are provided in all regions of Russia. In addition, through this organization, pensions are received by citizens of foreign countries who, in accordance with current legislation, have the right to receive payments.

The pension fund assigns allowances not only to elderly citizens, as is commonly thought. Despite the fact that most of the fund’s funds are spent on paying old-age insurance pensions, the PFR’s task is to provide for other socially vulnerable categories of citizens - disabled people and minors who have lost their breadwinner.

How one of the largest social institutions of the state, the Pension Fund of Russia has a branched and complex structure, which we will try to understand in the framework of this article.

The year 1956 in Russian history was marked by the famous 20th Congress of the CPSU, where the personality cult of Joseph Stalin was officially debunked, as a result of which fundamental changes were initiated in the social life of Soviet society. However, this date is also significant because with the release of the law “On State Pensions,” workers and employees could count on receiving a monthly cash disability benefit in old age.

Reference! In 1964, this right, although in a somewhat truncated form, also became available to residents of rural areas working on collective farms. Since this time, we can say that the pension system has fully developed in the Soviet Union.

At that time, the country's economy was completely under state control. Local organizations and enterprises were managed within the framework of the Soviet planning doctrine. In this regard, the state, in fact, was the only employer, and therefore the pension was paid from the country’s budget.

At the end of the Soviet era, the economy and public administration system found themselves in a deep crisis. In this regard, the state distanced itself from fulfilling its obligations under the new conditions. On this background in 1990 the Russian Pension Fund was created, which, although it remained a state organization, nevertheless had a certain degree of independence, and the funds at the disposal of the Pension Fund of the Russian Federation were not part of the budget at any level.

Over the last decade of the 20th century, the Pension Fund experienced significant difficulties with occupancy, however, as the economic situation in the country improved, the pension system stabilized, although it is being actively reformed, including in the modern period.

Functions of the pension fund today

For the sake of which the decision was made to create the fund, it is the management of funds through which the pension system in the country is provided. This is expressed in the accumulation of money supplied to the fund through mainly insurance contributions, and in the payment of pensions to citizens entitled to it. The Pension Fund of Russia still copes with this task today.

In addition, the functions of this organization include:

- administration of a personalized accounting system;

- co-financing of certain social programs;

- monitoring the receipt of insurance premiums and supervising the fulfillment by policyholders of their obligations under compulsory insurance;

- issuing certificates of maternal capital and monitoring the expenditure of its funds.

Important! At the moment, the Russian Pension Fund is also one of the largest employers - in total, more than 100 thousand people work in its structures.

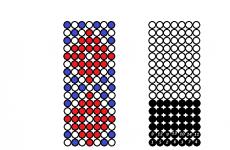

Pension Fund structure diagram

The large volume of tasks assigned to this organization and the impressive staff determines the complex organizational structure.

The easiest way to present it is in the form of the following diagram:

The main administrative body of the fund is the board. Drozdov A.V. has been the head since 2008. It is the chairman who approves and also makes key decisions on issues related to the functioning of the pension system.

The board also includes deputy chairmen. Each of them specializes in certain areas of the Pension Fund’s activities.

An integral part of the structure of the pension fund is the audit commission. Its task includes internal audit, including checking the validity of spending the organization's budget.

The information center appeared in the structure of the Pension Fund quite recently - in 2015. His activities are aimed at supporting electronic systems in the organization.

About the executive directorate

The executive directorate is headed by one of the deputy chairmen of the PFR board. This is the basic structure that determines the nature of the fund's ongoing activities.

The functions of the executive directorate are:

- determination of the Pension Fund budget, analysis of its revenue and expenditure parts;

- distribution of funds by region;

- carrying out accounting and reporting provided to the board;

- making forecasts regarding the situation of the pension system as a whole.

The Executive Directorate carries out a supervisory function over the activities of local territorial bodies.

Territorial apparatus

The territorial bodies of the Pension Fund have a hierarchical structure. These include:

District departments

There are 8 district departments in total. Their number is equal to the number of federal districts in the country. Their main tasks are:

- supervision of the activities of regional branches

- planning the work of Pension Fund bodies;

- coordination of local management activities;

- implementation of statistical accounting in the jurisdictional territory;

- participation in the formation and preparation of the fund's budget.

Territorial branches

Territorial branches operate in a specific region, where they are responsible for:

- control of collection of contributions;

- coordination of local departments.

Attention! Regional branches receive complaints about unlawful actions of employees of municipal departments of the Pension Fund of Russia in the order of subordination.

Directorates and departments in cities and districts (municipalities)

It is these grassroots structures of the territorial apparatus that directly work with citizens. The responsibilities of their employees include:

- assignment of pension payments, including acceptance of relevant documents;

- accepting applications for maternity capital, issuing certificates;

- delivery of pensions;

- maintaining personalized records;

- administration of insurance premiums;

- consulting on pension issues;

- ensuring co-financing of regional social programs.

The Pension Fund of the Russian Federation is an extremely important and significant structure, the activities of which affect almost every citizen of our country. For successful and efficient work, an effective structure was developed, which, with minor changes, has existed for almost 30 years.

For more information about the Pension Fund system, watch the video:

Introduction

Pension provision is one of the most important socio-economic problems of modern Russia.

This topic will always be relevant, because it is no secret that all people care about their old age and try to somehow provide for themselves so as not to be left without a livelihood at a disabled age. For many years, the only guaranteed source of income after retirement upon reaching retirement age, or due to loss of ability to work, were state pension payments. Thus, all funds were accumulated in government accounts and then redistributed. Currently, new participants are appearing in the financial market - pension funds, which are not necessarily government agencies. Their goal is to accumulate capital through pension contributions for those people who are interested in their well-being after active employment. Statistical data is necessary when regulating pensions in the country.

Pension statistics have the following tasks:

· collection of data on the number of pension recipients;

· formation of the budget policy of the Pension Fund of Russia and control over its implementation;

· Forecasting and analysis of financial resources of the Pension Fund;

· Maintaining accounting and reporting;

· Current forecasting of long-term development of the pension system.

Completing these tasks is necessary for the successful functioning of the entire pension system. Their decision is based on a combination of a number of sources of information.

General characteristics of pension authorities

Currently in Russia, as noted earlier, there is no unified pension system. There are several reasons for this state of affairs, the main ones being: different sources of funding from which pension provision is provided - funds from the Pension Fund of the Russian Federation (PFR) and funds allocated from the state budget; various categories of persons - pension recipients - insured citizens and persons employed in the public service system, some other categories of citizens; legally established unequal conditions and norms for the provision of these cash payments, and, accordingly, the level of material support for their recipients, for example, higher pensions for civil servants, etc.

As a result, this led to the fact that a number of federal ministries and departments - the Ministry of Internal Affairs of Russia, the Ministry of Defense of Russia, the Ministry of Justice of Russia, the FSB of Russia, the Federal Tax Service of Russia, the Prosecutor General's Office of Russia, the Supreme Court of the Russian Federation - have independent pension services.

The largest volume of work on pension provision for citizens falls on the Pension Fund and its bodies. This is due to the fact that it “serves” the most common category of persons - insured citizens under the compulsory pension insurance system and, in certain cases established by law - members of their families, persons who voluntarily joined the compulsory pension insurance system, and some other categories. Therefore, in the future we will talk about organizing the work of only the “mass” pension service, which is the Pension Fund.

The Pension Fund of the Russian Federation and the system of bodies subordinate to it constitute a single, centralized multi-level system of bodies managing compulsory pension insurance funds in Russia, in which lower-level bodies are accountable to higher-level bodies.

Structurally, it can be presented as follows:

federal level - Pension Fund of the Russian Federation (board, executive directorate);

federal districts of the Russian Federation - departments

PFR in federal districts (structural divisions of the PFR);

level of constituent entities of the Russian Federation - territorial branches of the Pension Fund (in the corresponding regions);

local -- city (district) level -- management

(branches) of the Pension Fund of Russia in districts (cities).

At the federal level The pension system is managed by the board of the Pension Fund and its permanent executive body - the executive directorate.

* In the constituent entities of the Russian Federation there are regional branches of the Pension Fund of Russia,

Local level The pension system consists of pension administrations (branches, departments) located in districts and cities. They mainly perform the functions of assigning and paying pensions.

Based on these principles, the funds of compulsory pension insurance, and accordingly the Pension Fund of the Russian Federation, are not state property. They should be considered as the property of the persons insured under this insurance system and the employers who pay insurance contributions to the Pension Fund. Consequently, all funds paid by working citizens in the form of insurance pension contributions must be distributed among pensioners, taking into account their labor contribution. (This usually refers to the duration of employment, that is, the duration of payment of insurance premiums, and the levels of wages from which such contributions were levied.)

From 01/01/2002 Pension reform has been carried out in Russia. New pension laws come into force.

This means that pension payments are added to the basic part of the labor pension, which are calculated based on the total amount of insurance premiums paid by a specific person (or for him), which is recorded in his personal account - how much is credited, so much will be paid after his pension is assigned during the so-called survival period.

In addition, in the structure of pension payments, along with the basic part of the labor pension and its insurance part, storage part.

The pension system involves the calculation and issuance of special payments to citizens designed to replace wages in certain situations. The most widespread is the old-age labor pension, which is issued after reaching a certain age and replaces lost labor income.Many countries have their own pension systems, which differ in a number of parameters. For example, the age at which a person becomes entitled to a pension, the average size and the features of the formation of accruals vary quite widely.

There are two most common principles for forming a pension – distribution and savings. The first one historically developed earlier; it consists in the fact that pensioners receive payments from the funds contributed by working citizens. This scheme is sometimes also called the “principle of intergenerational solidarity.” It is quite convenient in a stable demographic situation, when the ratio of today's pensioners and working citizens changes little. If this ratio is prone to significant fluctuations, then the distribution system may not be effective. In addition, a rather important drawback of this principle is the inability for the future recipient of the pension to significantly influence the amount of payments.

The funded system provides for a direct dependence of the future pension on the contributions of the working person. In this case, all insurance payments are sent to an individual account, based on the data of which the pension is formed when the insured person becomes entitled to it.

Previously, in Russia, pensions were paid on a solidary (distribution) principle, but then it was decided to introduce elements of a funded system into pension provision. The pension was divided into insurance, basic (later included in insurance) and funded parts. Each person can manage the funds of the funded component of the pension independently.

The funded part of the pension is invested, which means it can generate income. How exactly to invest is decided by the insured person himself, however, it is known that the majority of working citizens of the Russian Federation currently do not show much interest in their pension savings, and therefore do not take any part in investing them.

State pension provision is an integral part of the Russian pension system, which, through interbudgetary transfers from the federal budget to the budget of the Pension Fund of the Russian Federation, provides citizens with state pension provision.

So, a state pension pension (state pension) is a monthly cash payment from the federal budget.

Certain categories of citizens have the right to receive this pension. According to Federal Law No. 166-FZ “On State Pension Provision in the Russian Federation”, such categories, for example, include civil servants, military personnel, and astronauts.

So, there are several types of state pensions:

1) long service pension;

2) old age pension;

3) disability pension;

4) survivor's pension;

5) social pension.

The fundamental difference between a state pension and pensions within the framework of compulsory pension insurance - insurance and funded - and non-state (non-state pension provision) is the following:

Recipients of pensions are narrow categories of citizens;

- the source of pension payment is the federal budget;

- the responsible fund is the Pension Fund of the Russian Federation.

- federal government employees;

- military personnel;

- astronauts;

- flight test personnel.

Military personnel;

- participants of the Great Patriotic War;

- citizens awarded the badge “Resident of besieged Leningrad”;

- citizens affected by radiation or man-made disasters;

- astronauts.

Military personnel;

- citizens injured as a result of radiation or man-made disasters;

- astronauts.

For disability;

- in case of loss of a breadwinner;

- due to old age.

Disabled people of groups I, II and III, including those disabled since childhood;

- disabled children.

Citizens who have reached 65 and 60 years of age (men and women, respectively) who do not have grounds to receive an old-age insurance pension;

- citizens from among the small peoples of the North: men - from 55 years old and women - from 50 years old. The state social pension is paid to them instead of the old-age insurance pension.

State pension provision

State pension provision is an integral part of the Russian pension system.The procedure for assigning pensions for state pension provision is regulated by Federal Law No. 166-FZ “On State Pension Security in the Russian Federation”.

State pension provision - ensures the provision of pensions to citizens under state pension provision (state pensions) through interbudgetary transfers from the federal budget to the Pension Fund of the Russian Federation.

The main distinctive feature of state pension provision is that state pensions are financed from the federal budget.

Pensions for state pension provision (state pensions) are assigned to certain categories of citizens, for example:

Civil servants (including military personnel),

socially vulnerable citizens,

participants of the Great Patriotic War, etc.

The state pension (state pension) is a monthly cash payment from the federal budget.

There are several types of state pensions:

State long service pension;

state old age pension;

state disability pension;

state survivor's pension;

social pension.

The fundamental difference between a state pension and pensions under compulsory pension insurance and pensions under non-state pension provision is the following:

Recipients of state pensions are narrow categories of citizens;

the source of payment of the state pension is the federal budget;

The fund responsible for paying the state pension is the Pension Fund of the Russian Federation.

The state pension for long service is assigned to the following categories of citizens:

federal government employees;

military personnel;

astronauts;

flight test personnel.

The state old-age pension is awarded to citizens who have suffered as a result of radiation or man-made disasters.

The state disability pension is assigned to the following categories of citizens:

Military personnel;

participants of the Great Patriotic War;

citizens awarded the badge “Resident of besieged Leningrad”;

citizens affected by radiation or man-made disasters;

to astronauts.

Disabled family members of the deceased are entitled to a state pension in the event of the loss of a breadwinner:

Military personnel;

citizens affected by radiation or man-made disasters;

astronauts.

Disabled citizens of the categories listed below have the right to a state social pension.

State social pension is of the following types:

For disability;

in case of loss of a breadwinner;

by old age.

The state social disability pension is established:

Disabled people of groups I, II and III, including those disabled since childhood;

disabled children.

The state social pension in the event of the loss of a breadwinner is established for children under 18 years of age, and in the case of full-time education in educational institutions - until completion of education, but not longer than 23 years of age, for those who have lost one or both parents, and for children of a deceased single mother.

The state social old-age pension is established:

Citizens who have reached 65 and 60 years of age (men and women, respectively) who do not have grounds to receive an old-age pension: having insurance (work) experience of less than five years;

citizens from among the small peoples of the North: men - from 55 years old and women - from 50 years old. The state social pension is paid to them instead of the insurance pension.

Pension Law

The current pension system of the Russian Federation is a product of long-term reform. Changes in this system continue today - long-term development strategies are being developed, new bills are being created, and amendments are being made to existing regulations.How should a pension be formed in accordance with current pension laws? The current tariff for insurance contributions involves the transfer of 16% of wages to the insurance part of the pension and 6% to the funded part. What is the difference between these two components? The insurance part (it includes the basic component of the pension, which is paid to everyone, as well as a significant part of pension contributions) is used to finance payments to current pensioners. The savings part performs a fundamentally different function - it is “real” money that can bring profit to its owner (a person insured under a compulsory pension insurance agreement).

The pension legislation of the Russian Federation is constantly being reformed. Significant changes occurred, for example, when elements of the funded principle began to be used to form pensions, and not just the distribution system.

One of the most important changes will be the change in the tariff of the funded component. As mentioned above, the current law on pension provision implies the allocation of 6% of contributions to the funded part of the pension. However, starting next year, the so-called “silent ones”, that is, those who did not join one of the non-state funds or did not inform the Pension Fund of their desire to keep the previous tariff, contributions to the funded part will be reduced to 2%.

Current legislation provides for a fairly wide range of possibilities for increasing payments after retirement for working citizens. One of the simplest and most accessible methods is the wise use of the investment, accumulative component of deductions. You can get the maximum benefit from this part of your savings by transferring management rights to it to a non-state pension fund. However, in this case, it is important to choose the right NPF, paying special attention to the balance of the fund’s investment policy, its reliability, operating history, guarantees, and also, of course, profitability indicators.

However, you can increase your pension not only with the help of smart investments and mandatory contributions. Participation in one of the non-state pension programs (NGOs), which provides for voluntary contributions that will be invested, generate income, and after retirement will return to the recipient multiplied, will help you receive a significant increase in basic payments from the state.

Pension provision for military personnel

Military service one day ends, and the retired officer has to find his place in civilian life. Having given part of their lives to defending the Motherland with arms in hand, former military personnel have the right to count on special treatment from the state upon their retirement or retirement.Officers, with appropriate length of service, can count on permanent housing and a military pension.

Pension provision for military personnel discharged from military service and members of their families is carried out in accordance with the Law of the Russian Federation No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, drug control agencies drugs and psychotropic substances, institutions and bodies of the penal system, and their families.”

Article 43 of this Law establishes that pensions for military personnel and their families are calculated from monetary allowances. Salaries by position, military rank are taken into account (without taking into account the increase in salaries for service in remote, high-mountain areas and in other special conditions) and a percentage bonus for length of service, including payments in connection with the indexation of monetary allowances. Also, the size of the pensions of dismissed military personnel depends on the duration of military service, positions occupied before dismissal and assigned military ranks.

Article 13 of this Law establishes that the right to a long-service pension is given to persons who have served 20 years or more, as well as persons dismissed from service upon reaching the maximum age for service, health reasons or in connection with organizational and staffing measures and reaching day of dismissal 45 years of age, having a total work experience of 25 calendar years or more, of which at least 12 and a half years are military service.

According to Article 14 of this Law, the long-service pension is established in the following amounts:

For military personnel with 20 years of service or more: for 20 years of service - 50% of the corresponding amounts of pay and for each year of service over 20 years - 3% of the specified amounts of pay, but in total no more than 85% of these amounts;

military personnel with a total work experience of 25 calendar years or more, of which at least 12 and a half years are military service: for a total work experience of 25 years - 50% of the corresponding amounts of pay and for each year of service over 25 years - 1% of the specified amounts monetary allowance.

The increase in pensions for dismissed military personnel is carried out in accordance with Article 49 of this Law simultaneously with an increase in the salaries of military personnel in service, based on the level of increase in the monetary allowance of the corresponding categories of military personnel taken into account when calculating pensions.

For pensions assigned in accordance with this Law to certain categories of citizens, if there are appropriate grounds, it is provided for the establishment of various increases, allowances and raises, calculated as a percentage of the established amount of the social pension:

Increases in the amount of long-service pensions for disabled people and their amounts are established by Article 16 of the Law;

pension supplements for length of service and their amounts are established by Article 17 of the Law;

supplements to the disability pension and their amounts are established by Article 24 of the Law;

Survivor pension supplements and their amounts are established by Article 38 of the Law;

increases in pensions for long service (for disability, in case of loss of a breadwinner) and their amounts are established by Article 45 of the Law.

Decree of the President of the Russian Federation No. 1091 increased the monthly supplement to pensions established by Decree of the President of the Russian Federation No. 176 “On establishing a monthly supplement to pensions for certain categories of pensioners.”

The draft Federal Law of the Russian Federation “On monetary allowances and other payments to military personnel of the Armed Forces of the Russian Federation” was posted on the website of the Ministry of Defense.

This law is the basis for the long-overdue reform of military pay and their pensions.

For all military personnel (both personnel and reserve), paragraph 3 of Article 1 is very important: “Salaries for military positions and salaries for military ranks are increased (indexed) annually in accordance with the federal law on the federal budget for the corresponding year and planning period, taking into account inflation rate (consumer prices).”

That is, the law relieves the military from anyone’s political will, including the top officials of the state, and puts the process of indexing military pensions on a legal basis.

The main thing for military pensioners is paragraph 1 of Article 4:

“Pensions assigned to persons who served in the Armed Forces of the former USSR, the United Armed Forces of the Commonwealth of Independent States, the Armed Forces of the Russian Federation, the railway troops (military pensions), as well as their families are calculated in the manner determined by the Government of the Russian Federation, based on salary according to military rank, salary according to position and monthly bonus for length of service, which constitute the monetary allowance taken into account when calculating his pension. The specified monetary allowance is taken into account when calculating the pension in the amount of 30 percent and increases annually by 3.5 percent until it reaches 100 percent of its amount.”

Pension authorities

Local pension provision is carried out by district (city) departments and Pension Fund departments (hereinafter referred to as local pension provision authorities). In certain settlements of districts, for example in large towns and cities, positions of authorized Pension Funds of the Russian Federation may be established, which are subordinate to these bodies.Local pension authorities are the legal successors of the social protection authorities of the district (city) in terms of the assignment, recalculation and payment of labor pensions and state pensions, as well as social benefits for the funeral of deceased pensioners who were not working on the day of death.

Local pension authorities are directly subordinate to the territorial branch of the Pension Fund.

It is the local pension authorities that bear the greatest amount of work in providing citizens with pensions. The content of their work is varied.

They perform a variety of functions, namely:

Acceptance of documents for the assignment of pensions;

- assignment, recalculations, payment of pensions;

- delivery of pensions;

- financial support for pensions;

- interaction with other government bodies and institutions, organizations of all forms of ownership;

- reception of the population on pension issues;

- work with public organizations;

- maintaining individual (personalized) records;

- inspection of organizations of all forms of ownership for compliance with legislation on pensions;

- organizing and conducting educational and methodological work on pension issues, etc.

Let us consider the organization of work of local pension authorities in the main areas of their activity.

Working citizens are represented for pension purposes by organizations, regardless of the form of ownership for which they work, and individual entrepreneurs using the labor of employees.

In organizations, by order (instruction) of the manager, an official is appointed who is responsible for the preparation of documents. In large organizations and enterprises, pension departments or commissions are formed.

Their main task is to correctly draw up documents for assigning a pension and submit them to the local pension authority in a timely manner. Organizations compile lists of people retiring in the next two to three years. The lists indicate the surname, first name, patronymic of the future pensioner, year of birth, date of upcoming retirement, total length of service (TS), preferential length of service (LTS), insurance length of service (SSt), and full home address. One copy of the list is sent to the pension authority of the district (city). During the period of compiling the list, the work books of future pensioners are checked, all types of length of service are calculated (LTS and SS are especially carefully checked). If necessary, missing documents on length of service, earnings, etc. are requested. All this is done in advance, so that by the time the citizen submits the application, all the necessary documents are available.

All enterprises, organizations and institutions located in the territory of the district (city) are distributed among employees of the local pension authority, who open a so-called observation file for each organization.

It stores:

Order (instruction) of the head of the organization on the appointment of a specific person responsible for the preparation of documents;

- lists of people retiring in the coming years;

- a list of production facilities and work with special working conditions.

Every year, an employee of the local pension authority inspects the enterprises, organizations, and institutions assigned to him with an on-site visit. As a result of the inspection, an act is drawn up and filed in the observation file. The heads of the enterprise and the local pension authority become familiar with the contents of the inspection report. In some cases, the results of the inspection are reported to the district (city) administration.

The act reflects the following information:

The total number of employees in the organization;

- availability of an extract from the order (instruction) of the organization’s administration on the appointment of a responsible person (representative) and his deputy;

- the presence or absence of a log of applications and submissions for the assignment of pensions (in the prescribed form), as well as a log or list of persons who, in connection with reaching retirement age, will acquire the right to a pension in two to three years, and a log of applications for recalculation of pensions ( in the prescribed form).

In organizations where there are production facilities or work with special working conditions, there must be extracts from Lists No. 1 and No. 2 of professions and positions that give the right to preferential pensions, the same extracts must be from these lists for the corresponding structural unit of the organization (workshop, department, area, etc.).

Non-state pension provision

At the moment, there are two types of pension provision in Russia - mandatory (state) and voluntary (initiated either by the employer or the citizen himself). A distinctive feature of non-state pension provision (hereinafter referred to as NPO) from state insurance is the fact that in order to enter into an NPO agreement, a person does not have to have work experience.Voluntary pension provision is additional to the state one and is implemented by concluding an agreement on non-state pension provision (hereinafter - pension agreement, NGO agreement) with a non-state pension fund (hereinafter - NPF).

Voluntary pension provision is aimed at increasing the size of pensions paid under compulsory pension insurance and involves regular transfer of pension contributions to the NPF over a certain period of time and their increase at the expense of investment income.

In this case, transfers of pension contributions can be made both by individuals in favor of themselves or other individuals, and by organizations in favor of their employees.

In general, non-state pension provision throughout the world is one of the most important points in an employee’s social security compensation package, along with wages, bonuses for the period of work, medical insurance, etc. If an enterprise implements a corporate pension program, future pensions in the form of pension savings are actually a form of deferred wages for employees. Participation of enterprises in pension programs strengthens employee trust in the employer, forms corporate spirit, and increases the rating of the enterprise.

But in Russia, this form of employee motivation is not widespread enough, and therefore, the employees themselves, trying to increase their savings by the time they reach retirement, are looking for the most understandable and effective ways to implement their plans, as an option, with the help of non-state pension provision. And this is reasonable, because the amount of additional pension through the pension system can reach 50%-60% of wages.

Non-state pension provision (NPO) is an additional type of pension provision, which is carried out by concluding an agreement with a non-state pension fund. The main feature of non-state pension provision in the Russian Federation, which distinguishes it from compulsory pension insurance, is the voluntary nature of the provision, as well as the possibility of receiving a pension without work experience. Thus, you can start building your pension yourself at the age of 18. The non-state pension system is aimed at significantly increasing the size of your pension. It involves regular voluntary transfer of contributions to the selected NPF. Due to the investment income received, your future pension will grow every year.

Each person, due to their individual characteristics, earnings and age, has a different understanding of a comfortable and financially independent existence upon reaching retirement age. Participation in a non-state pension program means you choose one of the pension plans. Depending on the scheme you designate, the size of the contribution, the frequency and volume of payments, as well as further terms for calculating the pension are determined and then an NPO agreement is concluded. You can make payments in favor of yourself, your child, or a loved one. If you are an employer, you can make payments in favor of an employee. The corporate pension program, in essence, is an addition to the social packages provided, as well as an opportunity to motivate employees. This not only increases employee trust in the company, but also improves its rating.

Types of pensions

The state pension for long service is assigned:Federal civil servants,

military personnel,

citizens from among the astronauts,

from among the flight test personnel with long experience in the relevant service (work).

If there is a long period of service in the state civil service of the constituent entities of the Russian Federation and municipal service, pensions for length of service are paid according to the rules determined by the constituent entities of the Russian Federation and municipalities independently.

The state old-age pension is assigned to citizens who have suffered as a result of radiation or man-made disasters.

The state disability pension is assigned:

Military personnel,

participants of the Great Patriotic War,

citizens awarded the badge "Resident of besieged Leningrad",

citizens affected by radiation or man-made disasters,

citizens from among the astronauts.

The state pension provision in case of loss of a breadwinner is assigned:

In the event of the death of military personnel,

citizens affected by radiation or man-made disasters,

citizens from among the astronauts and members of their families.

A social pension under state pension provision is assigned to disabled citizens who, for various reasons, have not acquired the right to receive appropriate insurance pensions.

For example, the following are entitled to it:

Citizens of the Russian Federation who have reached the age of 65 and 60 years, men and women, respectively (and they say that the retirement age has not been raised;

foreign citizens and stateless persons who have permanently resided in the territory of the Russian Federation for at least 15 years and have reached the specified age and whose insurance experience is less than 15 years.

However, such persons will not receive a social pension under the state pension system during the period of their work or other activities, when they are subject to compulsory pension insurance in accordance with the law.

Citizens entitled to simultaneously receive insurance pensions of various types are assigned one pension of their choice.

In cases provided for in paragraph 3 of Art. 3 of Law No. 166-FZ “On State Pensions”, simultaneous receipt of a pension for state pension provision and an insurance pension is allowed (Article 5 of Law No. 400-FZ “On Insurance Pensions”).

For example, citizens who become disabled as a result of a military injury have the right to receive a disability pension (clause 1, clause 3, article 3 of Law N 166-FZ “On State Pension Provision”) and an old-age insurance pension (clause 3, part 1, art. 32 of Law N 400-FZ “On Insurance Pensions”).

Pension provision for civil servants

Federal Law No. 173-FZ “On Labor Pensions in the Russian Federation” in accordance with the Constitution of the Russian Federation and the Federal Law “On Compulsory Pension Insurance in the Russian Federation” establishes the grounds for the emergence and procedure for exercising the right of citizens of the Russian Federation to labor pensions.Citizens of the Russian Federation who are insured in accordance with the Federal Law “On Compulsory Pension Insurance in the Russian Federation” have the right to a labor pension, provided they comply with the conditions stipulated by the Federal Law “On Labor Pensions in the Russian Federation.”

In accordance with the Federal Law “On Labor Pensions in the Russian Federation,” the following types of pensions are established:

Labor old-age pension;

disability labor pension;

labor pension in case of loss of a breadwinner.

Men who have reached the age of 60 and women who have reached the age of 55 have the right to an old-age pension.

The conditions for assigning labor pensions are determined by Chapter II of the Federal Law “On Labor Pensions in the Russian Federation”.

The insurance period includes periods of work and (or) other activities that were performed on the territory of the Russian Federation, provided that during these periods insurance contributions were paid to the Pension Fund of the Russian Federation.

A labor pension (part of a labor pension) is assigned from the date of application for the specified pension (for the specified part of a labor pension), except for the cases provided for in paragraph 4 of Article 19 of the Federal Law “On Labor Pensions in the Russian Federation”, but in all cases not earlier than the day the right to the specified pension (the specified part of the labor pension) arises.

The day of application for a labor pension (part of a labor pension) is considered to be the day the body providing pensions receives the corresponding application with all the necessary documents.

To assign an old-age pension, you must submit the following documents:

Passport;

Employment history;

Military ID;

Insurance certificate of compulsory pension insurance;

Personal account number in Sberbank of Russia through which pension payments will be made.

Federal Law No. 166-FZ “On state pension provision in the Russian Federation”, according to which federal civil servants with at least 15 years of experience in the state civil service and holding a position in the federal state civil service for at least 12 full months are entitled to a pension for length of service upon dismissal from the federal public service on certain grounds.

The conditions for granting a pension to federal civil servants are determined by Article 7 of this Federal Law.

A pension for length of service is established for persons who filled public positions of federal civil servants, approved by Decree of the President of the Russian Federation No. 1574 “On the register of positions in the federal public civil service,” as well as public positions in the federal public service provided for by the lists of public positions in the federal public service, which are the relevant sections Register of positions in the federal state civil service of the Russian Federation, approved by relevant decrees of the President of the Russian Federation.

Federal state civil servants with at least 25 years of experience in the state civil service and dismissed from the federal civil service on the basis provided for in paragraph 3 of part 1 of Article 33 of the Federal Law “On the State Civil Service of the Russian Federation”, before acquiring the right to an old-age retirement pension ( disability) are entitled to a long service pension if, immediately before dismissal, they held positions in the federal public civil service for at least 7 years.

The long-service pension is established in addition to the old-age (disability) labor pension assigned in accordance with the Federal Law “On Labor Pensions in the Russian Federation” and is paid simultaneously with it.

To apply for a long service pension, you must submit the following documents:

Employment history.

A copy of the dismissal order.

A certificate of the average monthly earnings of a federal civil servant for the last 12 full months immediately before dismissal from the federal civil service.

A certificate from the territorial body of the Pension Fund of the Russian Federation about the amount of the pension received for the month when the documents will be drawn up.

A copy of the pension certificate.

Copy of military ID.

Copy of the passport.

No. of the personal account in Sberbank of Russia through which payments of labor pension for old age (disability) are made.

In accordance with the Decree of the Government of the Russian Federation No. 570 “On the procedure for including periods of service (work) in public positions of the federal public service in civil service positions for federal civil servants and other positions of federal civil servants, determined by President of the Russian Federation,” the Ministry of Health and Social Development of Russia, by order No. 1648n, approved the Procedure for calculating and confirming the length of civil service for assigning a long-service pension to federal civil servants.

Pension provision procedure

Pensions for military personnel are provided from the federal budget. Its calculation is much simpler than the insurance pension for civilians: the pension is paid as a percentage of the salary received during the period of service; some categories are entitled to a percentage increase tied to the minimum state old-age pension.Pension provision for military personnel is regulated by Federal Law No. 4468-1.

He calls those eligible for a military pension who:

Served as officers, warrant officers, midshipmen or contract privates in the troops of the Ministry of Defense and other law enforcement agencies of the Russian Federation or the USSR (KGB, FAPSI, internal troops, border service, foreign intelligence agencies, civil defense, state security, etc.), as well as those created temporarily after the collapse of the USSR, the armed forces of the CIS;

served as officers or privates in the Ministry of Internal Affairs, the fire service (in different years it belonged to the Ministry of Internal Affairs, the Ministry of Emergency Situations and was even an independent department) or authorities controlling illegal drug trafficking.

They are also equivalent to:

Former conscripts and women who served as privates or senior officers;

conscripts - participants in the Second World War and command staff of partisan detachments - participants in the Second World War.

There are 3 types of pensions: for length of service, for disability and in connection with the death of the breadwinner.

This type of pension provision for military personnel is provided to the following categories:

Citizens dismissed from service who have at least 20 years of service in one or more law enforcement agencies;

persons dismissed no earlier than 45 years of age due to age, staff reduction, illness, and persons who have served at least 12.5 years, provided that their total work experience is 25 years (this includes work experience under the old legislation and insurance experience).

The basis here is the salary for the position and rank in which the citizen left, but as of the current moment (the pension is recalculated whenever salaries are increased). The allowance consists of salary according to position, salary according to rank and bonus for length of service.

However, Art. 46 of the mentioned law establishes an interesting rule: for the purposes of calculating pensions, monetary allowance is taken in the estimated amount of 54% of its real value. Every year the calculated amount must increase by 2% (the law on the federal budget may provide for an increased increase) in order to gradually reach the full amount of allowance.

Calculation of pension amount:

For 20 years of service in law enforcement agencies or for 12.5 years of service with a total experience of 25 years - 50% of the RDD;

for each year of service over 20 years, another 3% is added;

for exceeding 25 years of total work experience - 1% for each year.

In this case, the pension cannot exceed 85% of the RDV.

To receive a disability pension, military personnel must have a disability:

Arose during the period of service or within 3 months after dismissal;

came later, but arose due to illness (or injury) received in the service.

Thus, people with disabilities are distinguished:

Due to an injury received in service (they are entitled to a pension in the amount of half the RDA for disability group III and 85% for groups II and I);

due to an illness acquired during military service (they are paid a pension of 75% of the RDA for disabled people of groups I and II and 40% for group III).

When calculating supplements to all types of military pensions, the minimum social old-age pension is taken as the estimated amount of the pension (according to the law “On State Pensions”). That is, a 100% increase is equal to the current old-age pension.

This supplement is given to pensioners who are not working and meet one of the following criteria:

Having at least 3 dependents who do not receive a pension;

reaching the age of 55 years for women or 60 years for men (for disability pensioners);

reaching the age of 80 (for long-service pensioners).

With 2 dependents the allowance is 64%, with 1 - 32%.

The following are eligible to receive this pension:

Disabled children, stepchildren and spouses of military personnel, if they have lost their source of livelihood;

family members caring for disabled children, parents, brothers, sisters of the deceased breadwinner, under 14 years of age, and for this reason not working;

disabled family members - dependents of the deceased;

spouses of persons who died as a result of a military injury, caring for a common child under the age of 8 years (regardless of age, ability to work and availability of work);

parents and spouses of persons who died as a result of a military injury, if they are disabled, or after they reach the age of 50 (women) and 55 (men) years (regardless of their ability to work and whether they were dependent on the deceased serviceman);

stepfather and stepmother - according to the rules for parents, if they raised and supported the deceased for at least 5 years.

The pension is determined as a percentage of the RDV, similar to the length of service pension:

50% - to the relatives of a person who died from a military injury;

40% - to the relatives of a person who died from a disease acquired at his place of service.

Supplements to the survivor's pension are set at 100% of the social old-age pension for family members who are disabled in group I or have reached 80 years of age; in the amount of 32% - for disabled children or disabled children of groups I and II who have lost all their existing parents.

Each wife of a deceased military pensioner is entitled to a certain set of benefits. The presence or absence of a specific benefit is influenced by many factors: the nature of the husband’s service, the circumstances of his death, etc.

The benefits that a widow of a military pensioner can receive include:

Benefits for paying for housing and communal services;

home renovation benefits;

tax benefits;

compensation for travel to a sanatorium-resort institution and the burial place of a serviceman (once a year);

one-time reimbursement of expenses for moving to a new place of residence, including expenses for transporting property.

We can conclude that to calculate military pensions it is necessary:

Find out the salary for the position and rank in which the serviceman retired (or died), taking into account bonuses for length of service;

find out, according to the current law on the federal budget, the estimated amount of monetary allowance (as of today - 62.12% of the real one);

multiply the received amount by the percentage to calculate the pension specified in the law on pensions for persons who served in military service for the corresponding category of pensioners.

This is how we calculated the size of the pension. If a pensioner is entitled to bonuses, we count them too. We calculate the applicable premium as a percentage of this amount.

Thus, the size of the pension of military personnel is calculated according to the percentage of monetary allowance established by the law on the federal budget; the amount of bonuses based on the percentage of the old-age pension specified in the legislation on state pension provision.

Early retirement provision

Citizens of the Russian Federation insured in accordance with the Federal Law “On Compulsory Pension Insurance in the Russian Federation” have the right to an old-age labor pension, assigned early for work under harmful and difficult working conditions, provided they comply with the conditions provided for by law.They acquire this right subject to several conditions.

The first condition is that there must be citizens of the Russian Federation registered in the compulsory pension insurance system.

The second condition is the presence of the insurance period specified in Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”.

The third condition is the presence of experience in relevant types of work with difficult and harmful working conditions.

The fourth condition is reaching the appropriate age (in some cases, regardless of age) provided for by law.

For a certain category of workers, an old-age labor pension can be assigned early, regardless of the length of insurance coverage. For example, women who have worked in the textile industry for 20 years in relevant jobs are granted an old-age pension early upon reaching 50 years of age without requiring insurance experience, since in this case the required period of work for a woman in the textile industry of 20 years coincides with the duration of the insurance period , which is necessary for assigning an old-age pension to women on a general basis in accordance with the Law.

Some employees may be granted early pension regardless of age and regardless of the length of their insurance period. In this case, it is enough to work a certain number of years in the relevant types of work. For example, an old-age labor pension is assigned early to APs, regardless of age and insurance experience, to rescuers of professional emergency rescue services and units of the Ministry of the Russian Federation for Civil Defense, Emergencies and Disaster Relief who have worked for at least 15 years as rescuers.

In all other cases, an indispensable condition for acquiring the right to early assignment of an old-age labor pension is that the insured person has experience in the relevant types of work with difficult and harmful working conditions, as provided for in Article 27 of the Law.

Experience in relevant types of work is the total duration of periods of work in certain industries in professions and positions or in certain types of work provided for in Article 27 of the Law and the relevant Lists.

The mechanism for establishing length of service in the relevant types of work is of a special nature, therefore the procedure for calculating periods of work giving the right to early assignment of an old-age pension is regulated by separate regulatory legal acts.

In particular:

Rules for calculating periods of work giving the right to early assignment of an old-age labor pension in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”, approved by Decree of the Government of the Russian Federation No. 516;

- and clarification No. 5, approved by Resolution of the Ministry of Labor of Russia No. 29, which applies to the extent that does not contradict the Law and Resolution of the Government of the Russian Federation No. 516.

Rules No. 516 regulate general issues regarding the procedure for calculating individual periods of work for all categories of workers enjoying the right to early assignment of an old-age pension in accordance with Article 27 of the Law.

However, taking into account the special working conditions of certain categories of workers to whom an old-age pension is assigned early in accordance with this article, the procedure for calculating the periods of their work may be established by separate rules approved by the Government of the Russian Federation.

Thus, the procedure for calculating periods of work giving the right to early assignment of an old-age pension to civil aviation flight personnel is regulated by the above Rules, as well as the Rules approved by Decree of the Government of the Russian Federation No. 537.

The main contingent of recipients of early labor old-age pensions is contained in Lists No. 1 and No. 2 of industries, works, professions, positions and indicators that give the right to preferential pension provision, approved by Resolution of the Cabinet of Ministers No. 10 (hereinafter referred to as Lists No. 1 and No. 2) , as well as in Lists No. 1 and No. 2 of industries, workshops, professions and positions, work in which gives the right to a state pension on preferential terms and in preferential amounts, approved by Resolution of the Council of Ministers No. 1173 (hereinafter referred to as Lists No. 1 and No. 2 ).

To correctly determine the right to additional professional training is to establish, on the basis of relevant documents, the full compliance of the work actually performed or performed by a specific employee with the work and production that are provided for in the Lists.

Pension problems

The current system of state pension provision for the population is based on the principles of solidarity between generations and the distribution of part of the income of workers in favor of pensioners.In the conditions of a state planned economy and a relatively favorable demographic situation, the distribution system worked reliably and quite efficiently. State pensions provided coverage for the minimum needs of pensioners. The average pension was about 40% of the average salary.

Due to a complex of economic (transition from planned to market principles of economic functioning, privatization of most enterprises, reduction in real wages, rising cost of living, etc.), demographic and a number of other reasons, the purchasing power of state pensions has fallen to a level that does not provide pensioners with satisfaction minimum needs.

Despite the measures taken by the Government of the Russian Federation to increase the size of pension payments, recently there has been no noticeable improvement in the financial situation of pensioners.

At the same time, the level of state pension is at an extremely low level, not covering the minimum needs of a pensioner. Moreover, the higher a person’s earnings, the lower the replacement rate (for a significant part of workers it is below 10–15%).

This figure is significantly lower not only than in developed countries, but also in developing countries, where it is 60–70%. According to the standards of the International Labor Organization (ILO), for developing countries the minimum pension level should not be lower than 40% of average earnings.

Thus, the level of pensions in Russia does not cover the minimum needs of pensioners.

In the near future the situation may worsen significantly. A sharp increase in the load on the pension system is predicted (retirement of workers born during the post-war baby boom) against the backdrop of an accelerated aging process, which will require additional costs for pension provision. At the same time, the aging process of the population is accelerating, the main reasons for which are the decline in the birth rate and the high mortality rate of the working-age population. In many regions, the number of deaths exceeded the number of births by more than twice. And over the next 10–15 years, the trend of natural population decline will continue.

As a result, there is a gradual decrease in the specific share of those participating in the production process and an increase in the pension burden on workers. The consequence of this is an increase in the pension burden on the working population. Currently, only 5 workers provide pensions for 4 pensioners with their contributions. And in the next decade, this ratio between workers and pensioners will approach one to one (whereas for normal operation of the distribution system, the ratio should be at least 3 workers per 1 pensioner).

According to the forecast of the Pension Fund of the Russian Federation (hereinafter referred to as the PFR) and according to the forecast made by World Bank specialists, the ratio of the average pension to the average wage of workers (in fact, the level of purchasing power of the state pension) will worsen. Experts conclude that even if the pension reform is successfully carried out, the level of pension provision due to economic and demographic factors will not only not improve, but will most likely decrease. There is a decline in the birth rate and a deterioration in the ratio between the working and non-working population. At the same time, an increase in the tax burden is not expected. On the contrary, there is a gradual decrease in the unified social tax. Under these conditions, for objective reasons, pension growth lags behind wage growth. In other words, the real purchasing power of the state pension in the coming years will not only not increase, but will noticeably decrease.

The main reasons for the chronically low level of pensions:

1) low wages;

2) disinterest of employers and the population in increasing contributions to the Pension Fund. The consequence is the high debt of payers (industrial and agricultural enterprises) to the Pension Fund of Russia;

3) the pension system is burdened with a large number of preferential pensions, the source of payment of which are contributions received for all insured persons. This leads to sharp disproportions between the size of contributions to the Pension Fund and the level of their pension. The high level of burden of the state Pension Fund with obligations coming from the USSR (a large number of types of preferential pensions that are not secured by additional sources of income), which does not allow ensuring an adequately high level of pensions (replacement rate) due to the relatively high unified social tax.

4) a significant sharp deterioration in the demographic situation (declining birth rate, high mortality in working age, etc.) leads to a reduction in the number of workers, through whose salary deductions pension payments are provided to current retirees.

5) underdevelopment of the system of additional pension provision at the expense of employers and employees. Complete dependence of pensioners’ income on payments from the state pension system. The persistence of the stereotype that pensions, like other areas of social security (health care, education, etc.) are the sphere of concern only of the state. The state is fully responsible for citizens’ pensions (pay taxes and don’t think about the future). There is no understanding of the need to develop additional sources of funding for pensions. Reluctance of the state to develop NGOs. At the same time, the state does not create tangible economic and socio-psychological incentives for employers and employees to create additional sources of increasing pensions. Poor awareness of the population about pension reform and the prospects for a decrease in the purchasing power of pensions. Non-state pension funds cover only 6% of the population - the most profitable large corporations of export-oriented industries (fuel and energy complex, metallurgy, etc.), introducing Western wage standards, and natural monopolies. The overwhelming majority of the population does not have the opportunity to accumulate additional pensions in non-state pension funds - they are not available in the regions.

Thus, without major changes, the current pension system in the Russian Federation cannot stop the growing negative trends in reducing the level of pensions. Compensating for this decline will require additional pension costs.

Assignment of pension benefits

What will it take to receive government support in old age? What is the procedure for assigning a pension? Where should you go to become a pensioner?Each citizen, subject to the previously listed conditions, must appear at the territorial Pension Fund of Russia and write an application for the assignment of pension payments. He brings certain documents with him. Their list varies depending on the category of citizen.

Most often required:

An application of the established form (taken from the Pension Fund of Russia and filled out there);

ID card (passport);

SNILS;

details of the account to which the money will be transferred (preferably, but not required);

certificates of family composition (optional);

birth certificates of all children;

military ID (for men);

certificates indicating certain non-work periods that will be considered work;

work book;

documents confirming business activities (if available).

No more certificates will be required. The assignment and payment of pensions is carried out as quickly as possible. The list of required papers varies depending on the situation. Most often, it is necessary to attach certificates of disability.

From now on, it is clear how a labor pension or any other pension is assigned. We also know about systems for calculating pension payments. In the Russian Federation, the formation of the funded part of pensions has recently become of great importance. Often, citizens make voluntary contributions to non-state pension funds in order to later receive certain funds from the established fund.

Preferential pension provision

The legislation defines the right to preferential pension provision: early retirement for persons working in difficult and harmful conditions. For men this age is 60 years, for women – 55.The main indicator when calculating a preferential pension is length of service in hazardous working conditions.

Preferential old-age pensions are available to categories of citizens, regardless of their last place of work:

Persons working in underground work.

women engaged in collecting and processing tobacco.

full-time employees whose positions are indicated in lists No. 1 and No. 2.

drivers of urban public transport and trucks.

tractor drivers engaged in agricultural work.

To receive preferential pension benefits, provide a certificate of your place of work that meets the conditions for receiving benefits from the Pension Fund. The assignment of benefits to labor veterans and pensioners in accordance with Lists No. 1 and No. 2 must be confirmed by certification results of working conditions. The frequency of certification is carried out at least once every 5 years by the company’s collective agreement. The head of the company is responsible for the quality of certification.

The Pension Fund does not often provide preferential pensions on the second list. Due to numerous violations of certification rules that distort the facts and violate the pension rights of employees. According to information received from trade unions, at many enterprises certification is carried out with great violations, and at some it is not carried out at all. Preferential pension provision can count only five years of service spent in hazardous work. Such actions primarily affect employees who cannot receive tax benefits for pensioners due to incomplete compliance with the certification conditions. The employee is forced to contact various departments and even defend his rights in court.

The procedure for receiving a preferential pension in accordance with Lists No. 1 and No. 2 requires attention from the state. The fact is that the existing mechanism for reimbursement of such pensions is quite burdensome for enterprises, so they avoid it. At the moment, to solve this problem, the Ministry of Labor together with the FPU are studying this problem in order to correct the situation without consequences on the part of workers and employers.

Calculation of old-age pension payments: to whom they are assigned, how and in what time frame. Features of the calculations: what affects the value, what is included in the length of service, how the coefficients are determined, description of the formula used. Possible problems when applying for an appointment to the Pension Fund.

Pension benefits for doctors, or rather, early retirement, are provided for by the federal law on labor pensions.

Preferential pensions, transportation costs, budget payments, benefits for working pensioners, financial assistance and medical care.

Calculation of old-age pension payments: to whom they are assigned, how and in what time frame. Features of the calculations: what affects the value, what is included in the length of service, how the coefficients are determined, description of the formula used. Possible problems when applying for an appointment to the Pension Fund.

Mandatory pension provision

The definition of state pension insurance was given in the Federal Law “On individual (personalized) accounting in the state pension insurance system.” It explains the concept and essence of compulsory pension insurance, which was introduced as a result of the reform of calculating pensions for work.Compulsory pension insurance is a set of legal, economic, coordination measures developed by the state, which is aimed at compensating citizens of the country for any types of earnings that they previously had before the start of retirement age.

Insurance subjects include government bodies at various levels from federal to local administrative centers, policyholders, insurers, and insured persons.

Pension insurance is called compulsory if it operates legally by involving all categories of the country's population in it. There are state and non-state pension funds operating in the country, which provide pensions.

The organizational structure for assigning pensions that has developed in the Russian Federation is divided into:

Mandatory pension provision, which is assigned in the event of old age, disability, or loss of a breadwinner;

voluntary, covering pensions paid through contributions paid by employers together with independent pension savings of citizens.

Non-state pension funds are given the right to operate under both structures.

Pension security is a monetary benefit represented by a set amount that is regularly paid by the state to a recipient who has reached a certain age or upon completion of employment as a benefit.

The pension is paid from the time when the above events occur until the end of life.

It is divided into parts:

Basic or social, it is paid by the state regardless of the salary received, the amount of insurance contributions paid to all persons who have reached retirement age and have a minimum work experience of five years;

insurance, depending on the amount of payments made to the Pension Fund under the insurance contract while the labor activity lasted. It is calculated as the ratio of the pension capital accumulated before the day the pension was assigned and the number of months of waiting for payments, which is equal to 228 months or 19 years;

funded, which is influenced by accumulated pension contributions, so younger age categories of citizens can apply for it.

The regulation of the procedure in the Federation by the state is based on the norms of the Federal Law, issued No. 167-FZ, which defines the legal role of the subjects, the regulations of their legal relations, the grounds for their emergence and methods of exercising rights and obligations, and the level of responsibility of each subject is noted.

The adopted Federal Law “On Compulsory Pension Insurance” made it possible to implement a pension reform, according to which citizens of the country had to become insured persons.

It provided for the opening of individual personal accounts for citizens with insurance, where the employer regularly transferred insurance premiums every month in his favor when calculating wages. These payments accumulate, forming a future pension for work activities.

Insurance premiums in the personal account are invested in the financial market, due to which a certain additional amount is formed, which is added to the accumulated funds.

The savings part is at the full disposal of the State Management Company, which keeps it in the current account of Vnesheconombank. Every citizen in the Russian Federation has the right to dispose of the funded part of the pension at his own discretion, and he also determines the method of investment.

If there are no proposals from him for the use of accumulated funds, then they are transferred from the Pension Fund to the account of the State Management Company. However, a citizen has the right to make a contribution to a non-state foundation, transferring to it the rights to trust management.

A lifelong pension will be paid to a citizen of the Russian Federation upon reaching the retirement age. It will include accumulated funds and income received as a result of their subsidies.

Compulsory pension insurance, as part of the pension system of the Russian Federation, performs functions that make it possible to protect citizens in cases of insurance risks.

It is carried out by the Pension Fund, which performs the functions of an insurer, whose responsibilities include:

Exercising control over the correct calculation of insurance premiums and their timely transfer to the Pension Fund in full;

appointment and implementation of timely payments for all types of insurance pensions, taking information from an individual account as a basis;

verification of documents for accrual of compulsory insurance coverage;

drawing up a draft PF budget and ensuring its implementation;

ensuring the targeted use of financial resources;

accounting for incoming finances;

registration and deregistration of policyholders;

monitoring the receipt of insurance premiums from individuals who voluntarily entered into legal relations;

creation of a state database on various groups of policyholders;

providing regulations that allow maintaining a special part of an individual account;

ensuring the organization of timely accounting of income received from investing funds;

free consultations at all levels of regional bodies of insured persons and policyholders;

accepting applications from individuals to voluntarily enter into legal relations;

consulting, informing insured persons regarding the payment of additional contributions, posting information on the official website of the Pension Fund, the media;

performing the functions of a personal data operator;

determining the amount of insurance payments accrued to the insurance and funded parts of pensions.

The main goal is to provide citizens of retirement age with a decent standard of living, for which conditions are created for them to have an additional pension.

State bodies, together with non-state pension funds, have developed a number of special programs that are focused on the introduction, improvement and development of mechanisms for implementing pension insurance.

Compulsory pension insurance programs are attractive because they have flexible regulatory conditions that can be implemented easily and quickly according to the requests of a specific insured person.

Its advantages are:

If the period during which the accumulation is made ends, the accumulated funds can be withdrawn in full or received in equal monthly installments for the rest of your life;

if the insured person dies before the end of the accumulation period, then they are transferred to the heirs;

if the insured person is unable to make contributions for any period of time, then the amount of the future pension is recalculated depending on the amount accumulated until the suspension of payments;

If the insured person dies, the successor is paid the funds collected up to that time. The payment deadline is specified in the contract or when amendments are made to it, but before payments begin.

A pension insurance contract is an agreement concluded by a pension fund and the policyholder in the interests of the insured person or his legal successor, according to which the fund undertakes to assign and pay to him upon reaching retirement age the cumulative part of his labor pension or to make payments to his legal successors in the event of his death.

The agreement describes:

Rights and obligations of the Pension Fund, the insured person;

accounting for savings received from the insured person and their subsidies;

regulations, conditions of appointment, making payments from the funded part of the labor pension;

the procedure for issuing the savings of a deceased insured person to legal successors;

liability of subjects for committed offenses related to the fulfillment or improper fulfillment of obligations assigned to them by agreement in accordance with the norms of the legislation of the Russian Federation;